Corporate Banking App

Bank of China (Hong Kong)Overview

Timeline

7 Months

(Mar 2023 - Sep 2023)

Team

- UX Head

- Business Product Managers

- IT Product Managers

- IT Department

- Customer Service Team

- Marketing Team

- Data Analysis Team

- Research Agency

Contribution

- Gather Feedbacks & Data

- Feature Prioritization

- Information Architecture

- High-level UX Design

- Customer Journey Mapping

- UI Design Drafts

- High-fi Prototyping

- Concept Testing

After 4 years of operation, the iGTB platform, serving 130,000 customers, received negative feedback on usability. A major revamp was needed to regain customer trust.

As the lead UX contributor, I gathered data, conducted pain-point analysis , and discovered opportunities to tailor the mobile app for small corporations. I developed the platform’s information architecture (IA) and drafted UI designs for early concept testing , iterating based on user feedback. I also collaborated with business and development teams to co-create customer journeys and estimate costs, helping management finalize the shortlisted features.

Once the core UX framework was validated, the work was handed off to product designers for final execution and launched in mid-2024.

Final OutcomeBusiness Problem

Low ratings with negative feedbacks from various channels.

Customer service overwhelmed by users failing simple tasks.

- Fix the most valuable customer journeys

- Introduce features to benchmark against competitors

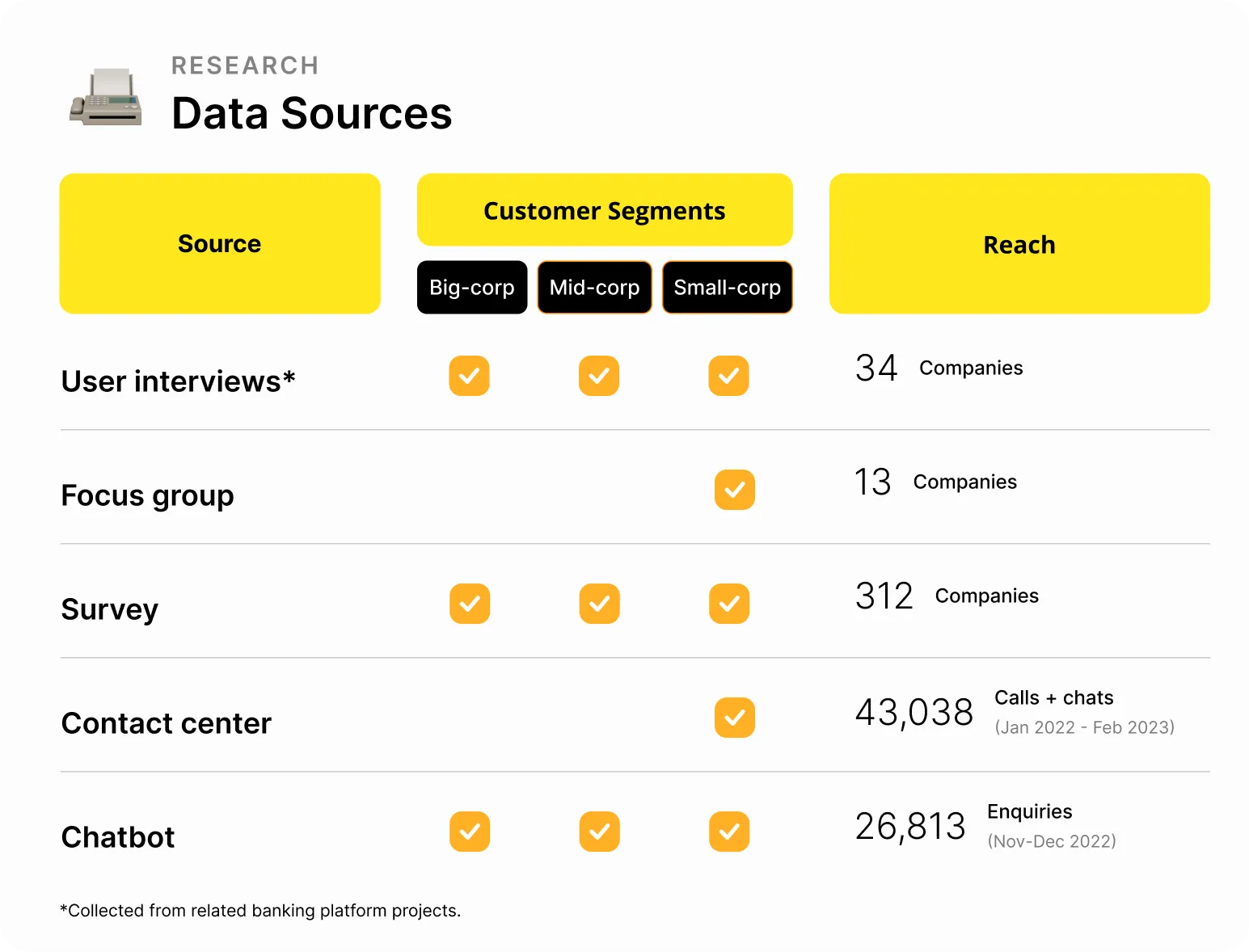

Data Gathering

Coordinating Cross-Departmental Data Collection

Reviewed key user flows and analyzed competitor structures, such as payment, to understand usability issues, like why users fail to find entry points.

Identifying Navigation Issues

One major issue identified was navigation. Unlike competitors, who separate payment options into “send to myself” and “send to others,” our platform displays all payment methods at once, overwhelming users and making it difficult to choose.

Diverse Data Sources

Leveraging opportunities from related projects to interview hard-to-reach customers, along with existing data, data science expertise, and prior research, we gained a comprehensive understanding of the pain points across different customer segments.

Overcoming Data Collection Challenges

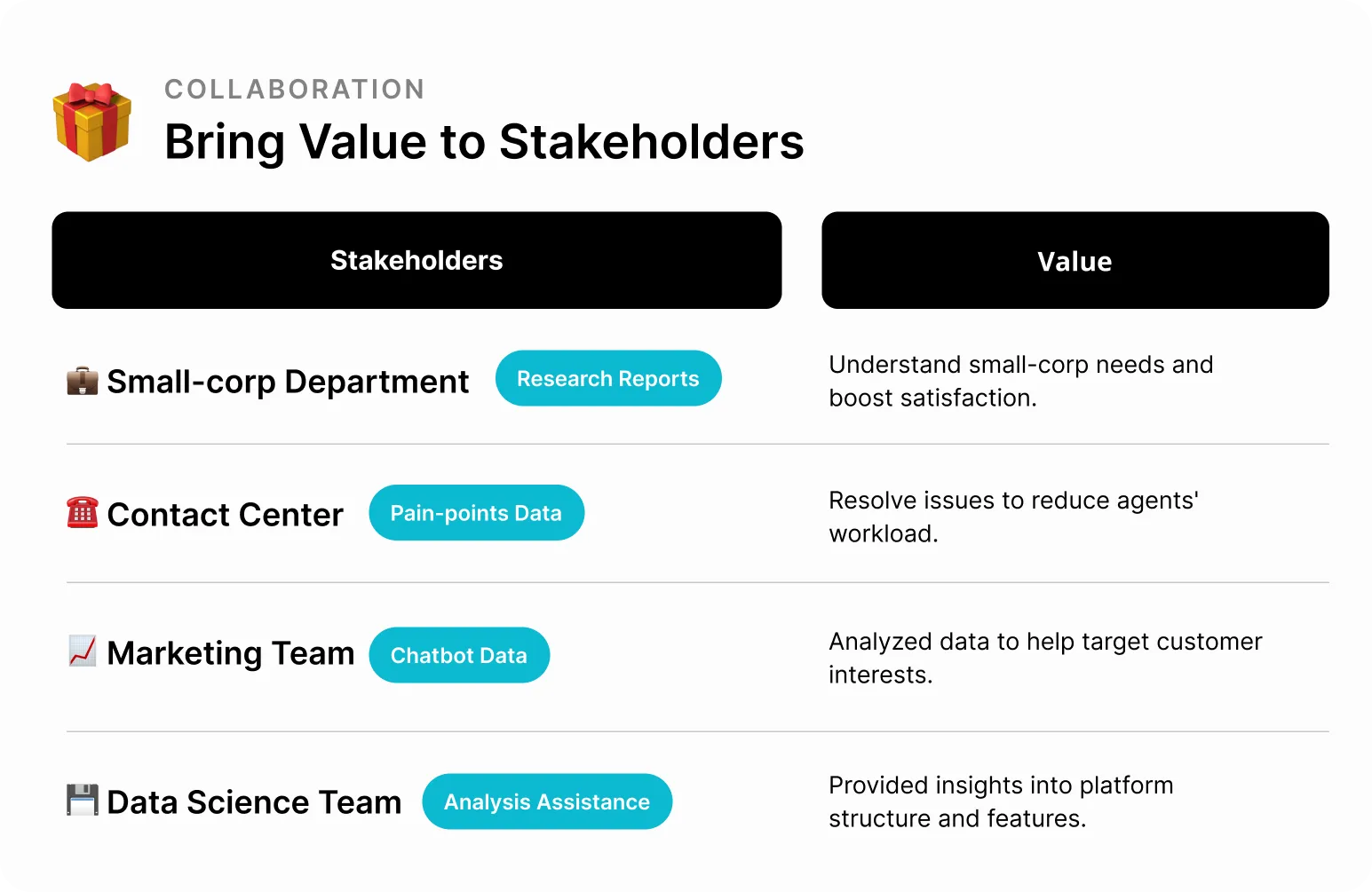

Data was scattered across teams, and we initially didn’t know some of it existed. The key to gathering it was our approach: providing value instead of just asking for help.

We built long-term rapport by exchanging information, offering UX support, and even just saying hi when we met.

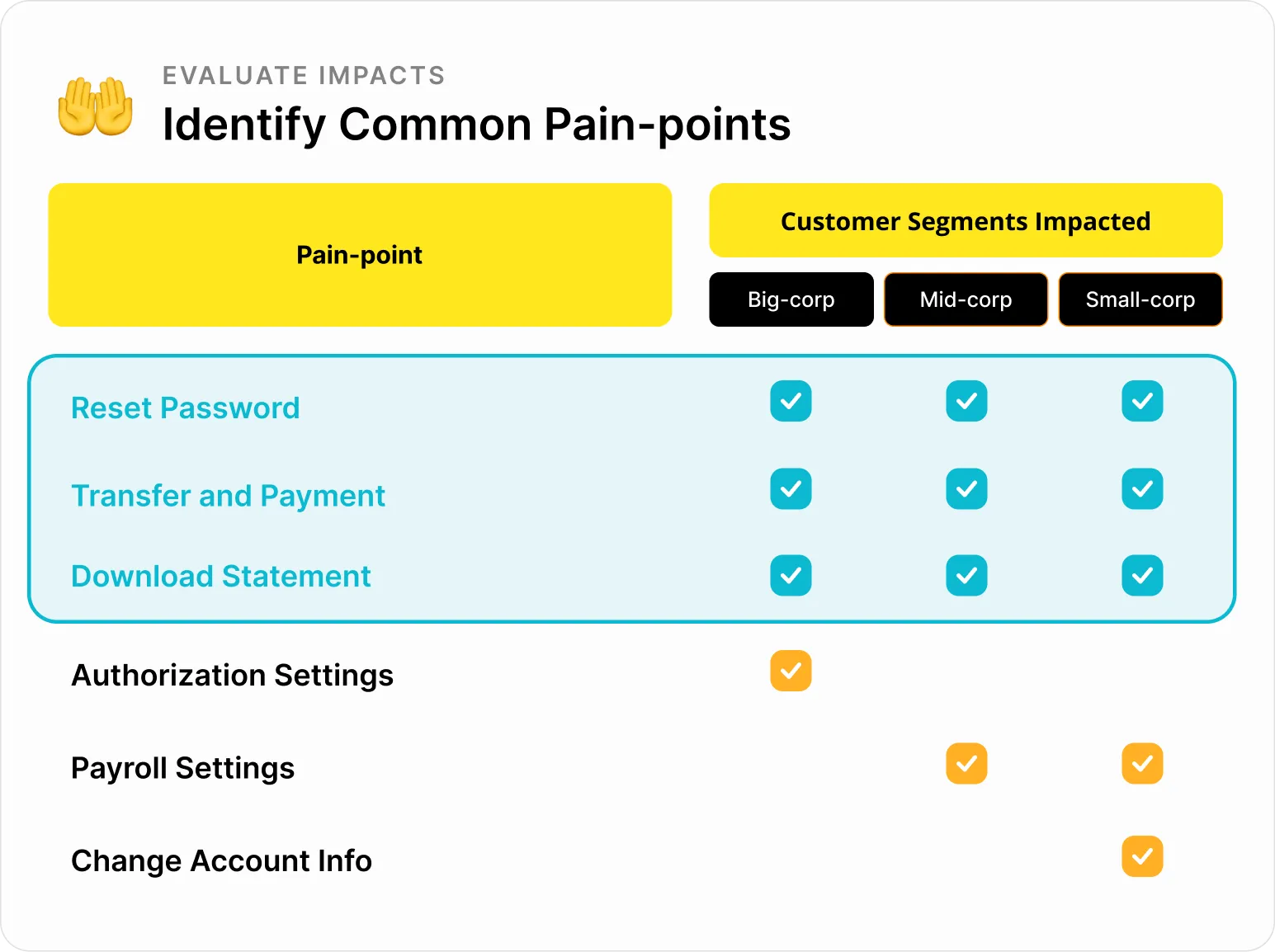

Pain-points Analysis

Translating Data into Business Decisions

Building on the data gathered from various departments, we identified the most critical pain points affecting customer satisfaction and operational efficiency.

This demonstrated the benefits of the revamp to each segment, convincing departments to invest in solutions aligned with their goals.

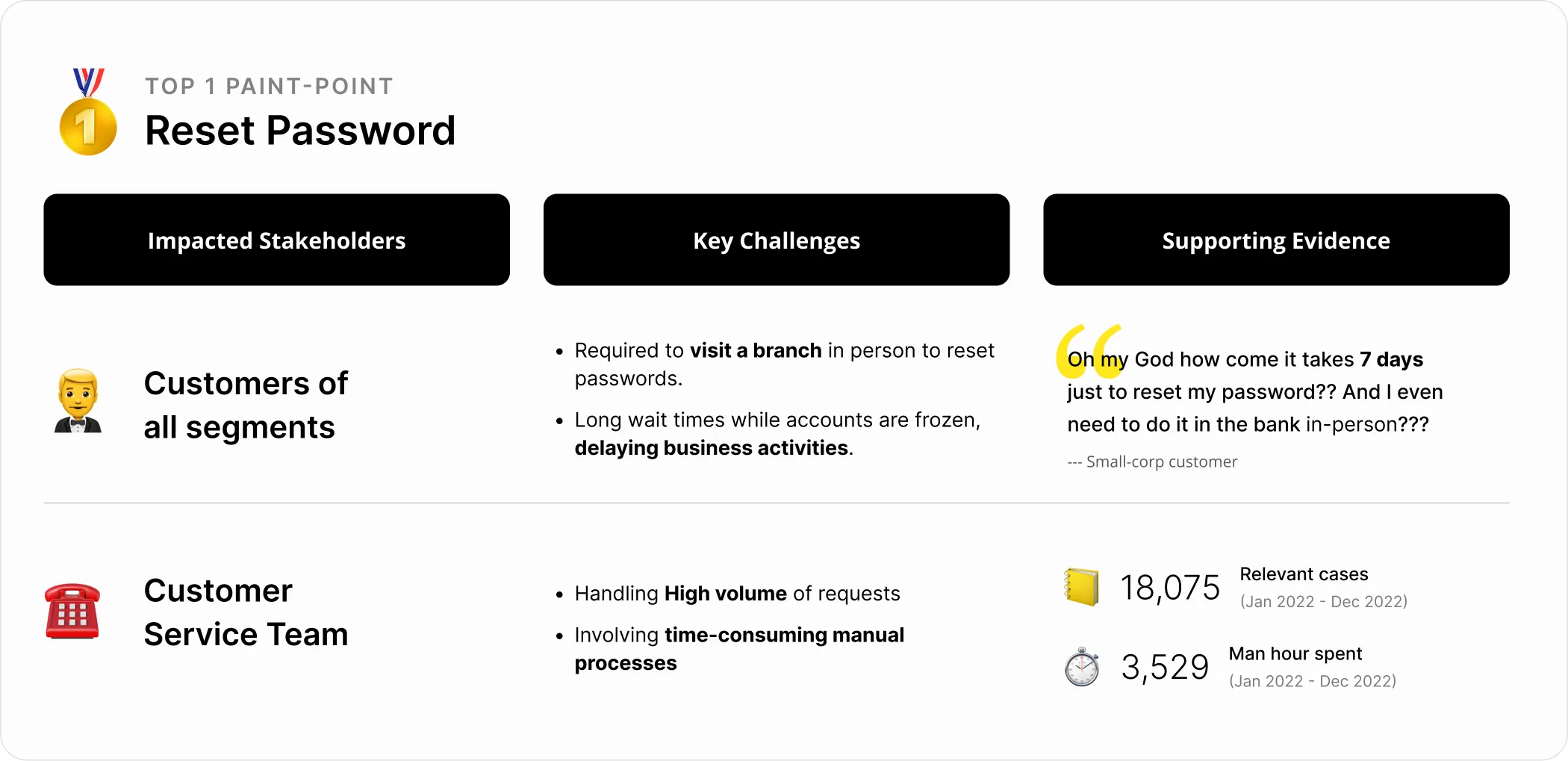

Prioritizing Common Pain Points

By focusing on issues that impact the most customers, we offer a roadmap for resource allocation that maximizes improvements across all segments.

Optimize App for Small-Corps

Distictive Segment Needs

Based on the pain points identified, we saw an opportunity to enhance the mobile app for small-corp users. While large corporations rely on the desktop platform, small-corp decision-makers, who often use the mobile app, faced more usability challenges.

Simplifying the Mobile Experience

Simplifying the mobile app by removing unnecessary steps and improving navigation directly supported the company’s goals of increasing app downloads and mobile token usage.

Growth in app downloads and active monthly users

Increase in mobile token activation

Improvements in small-corp customer satisfaction scores

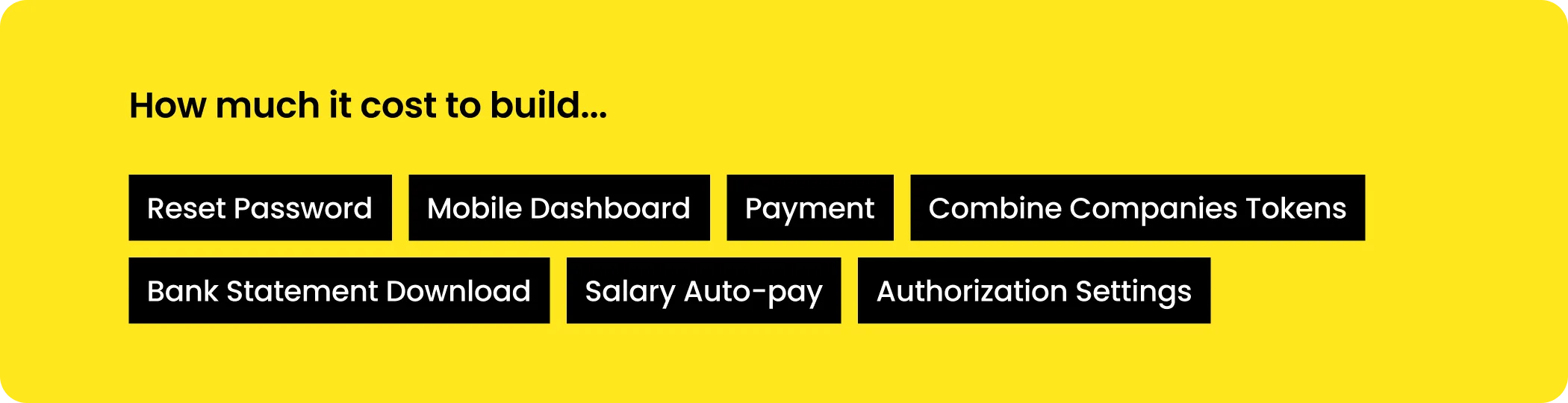

Solutions & Costs

Assessing Feasibility and Costs

With several valuable features identified, it was crucial to determine if the potential value justified the investment. By assessing costs and feasibility upfront, we ensured that only the most impactful features were prioritized for development.

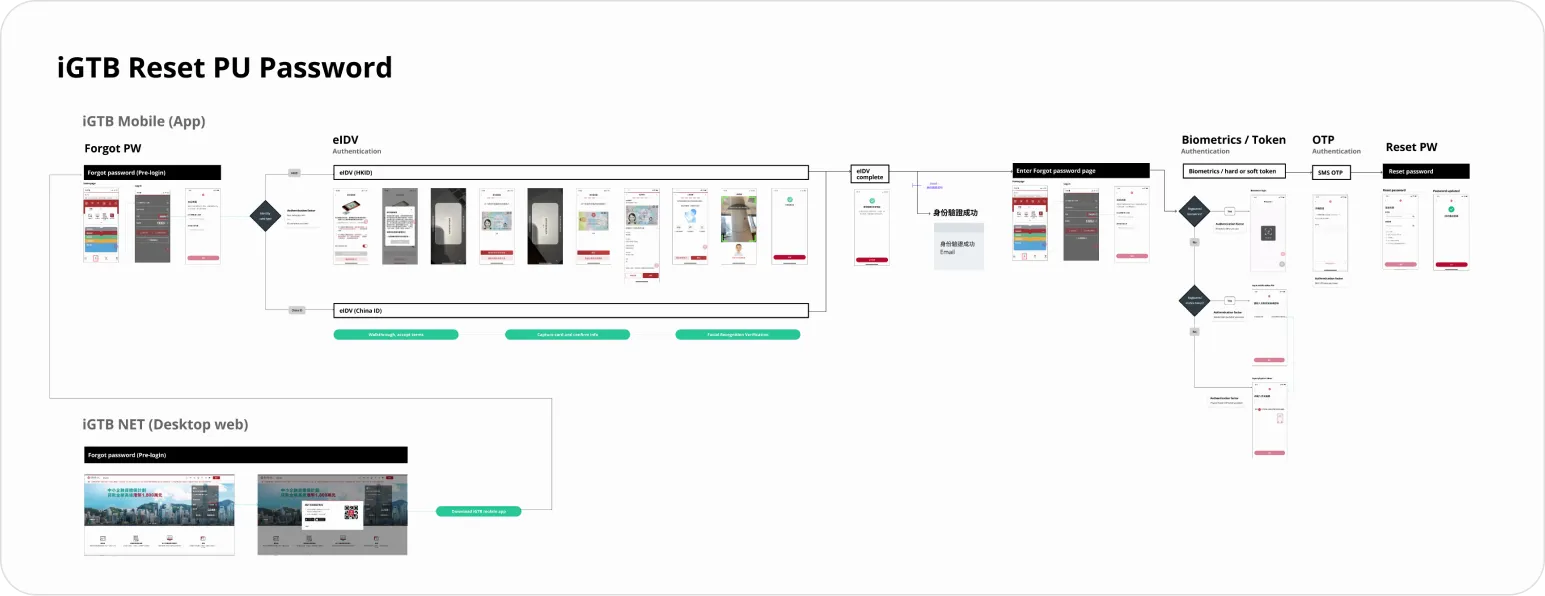

Collaborative Solution Development

To achieve this, we held regular meetings with business and IT teams. In these sessions, we reviewed customer journeys, with developers providing feasibility insights and suggesting implementation improvements. Business stakeholders made final decisions based on these discussions, aligning technical capabilities with business goals.

Shortlisted Features

These features were prioritized because they solve the most critical pain points, affecting all customer segments, reducing frustration, lowering operational costs, or achieving key business goals. The value they provide also justifies the cost.

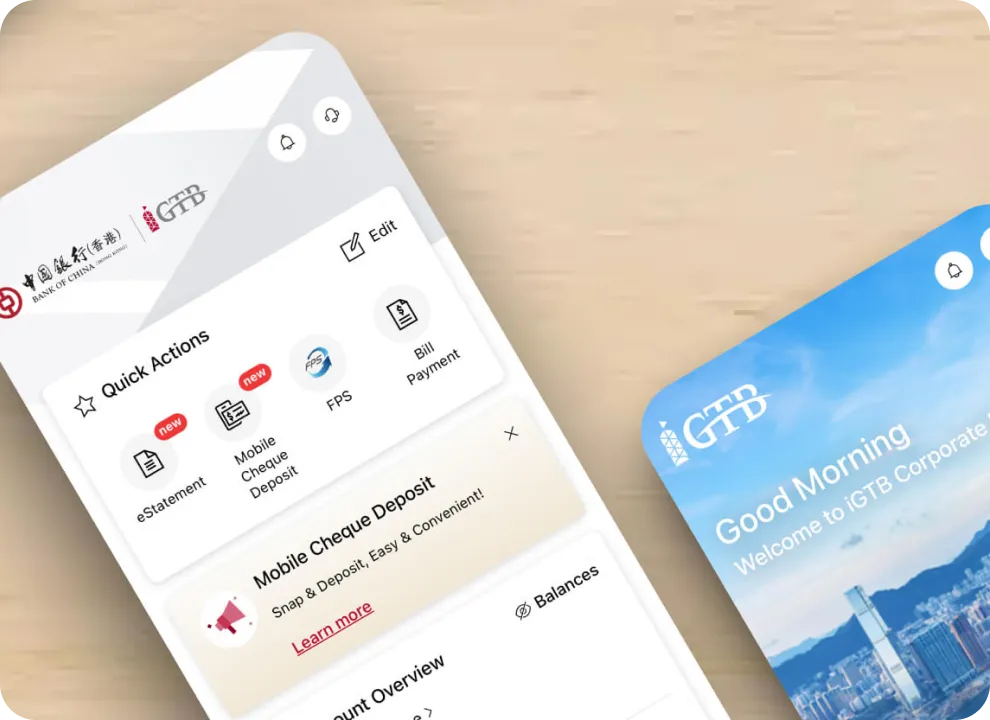

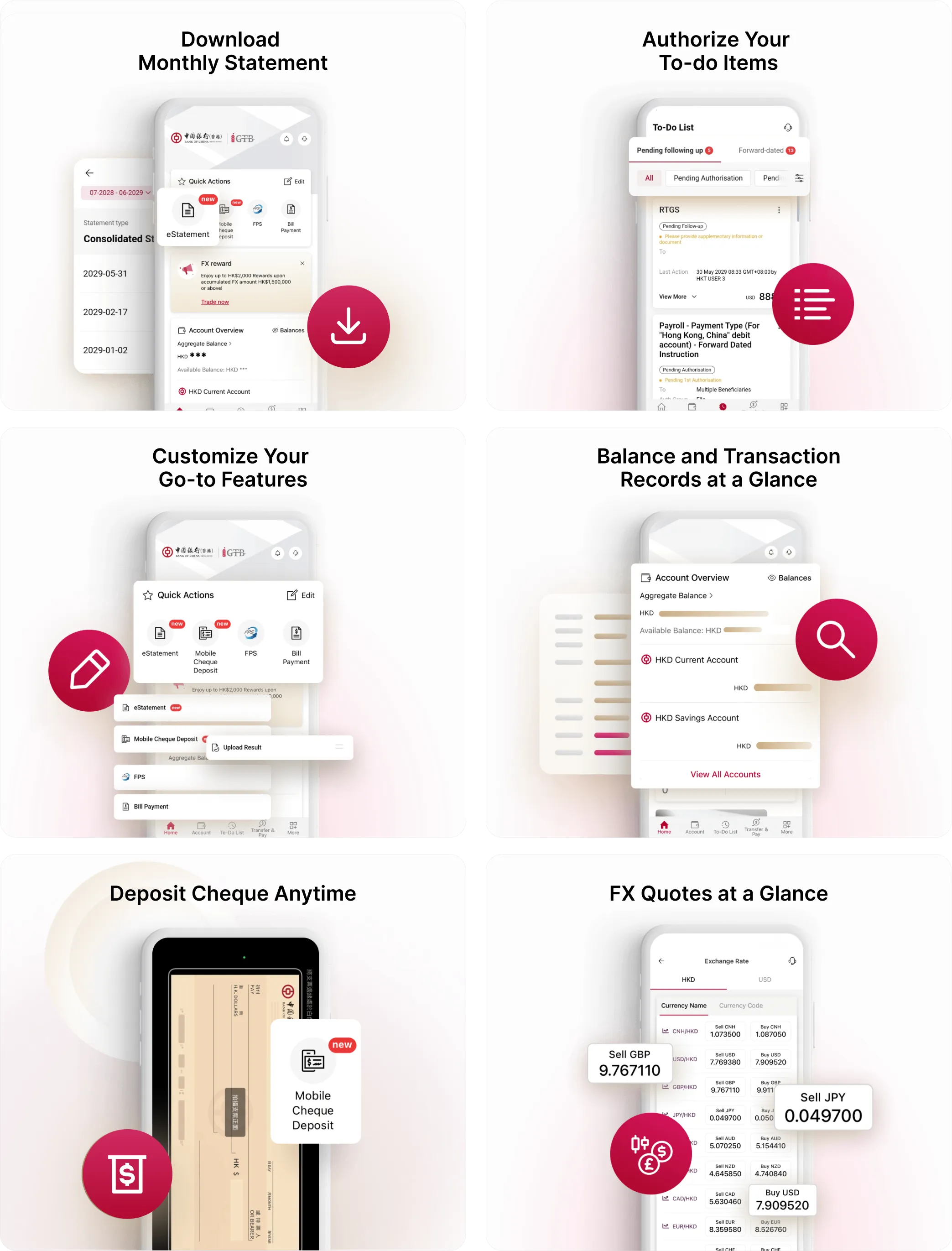

Mobile Dashboard

The signature revamp feature, optimizing navigation, offering monthly statement downloads, and showcasing a fresh design.

Reset Password

Streamlines the reset process, reducing the need for in-person visits and lowering internal operational costs.

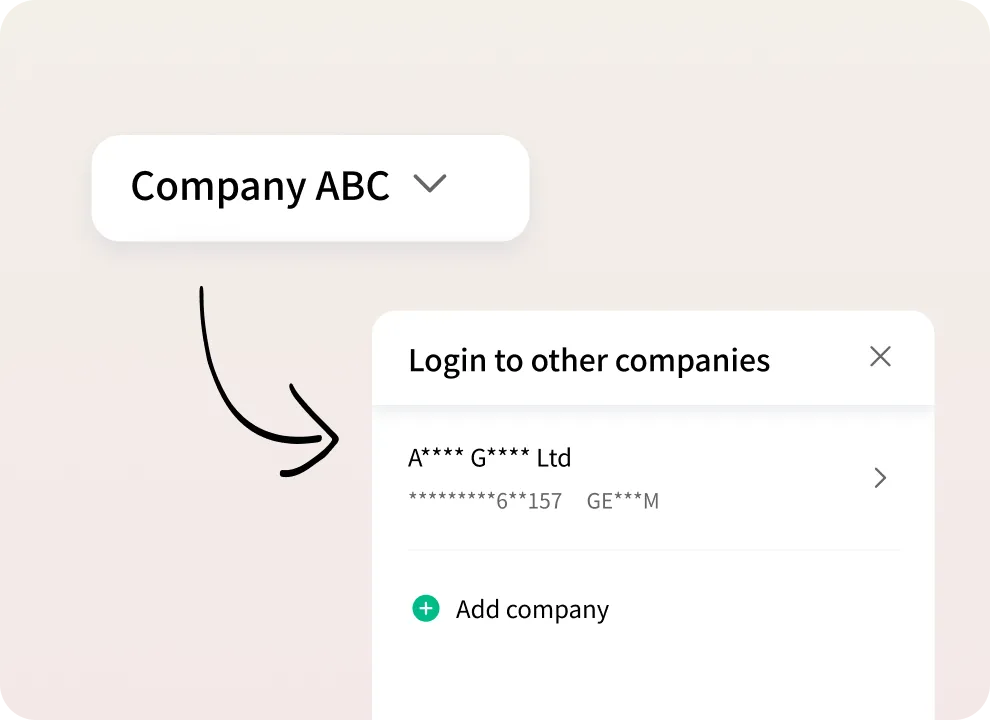

Link Companies

Encourages owners of multiple companies to use the bank for all their businesses with a simple single login.

Payment & Approval

Simplifies the entire payment flow, including batch approvals for big-corps and improving the telegraphic transfer (TT) process.

User Testing

Focus Groups with small-corps

To ensure the shortlisted features would meet customer needs and drive value, we conducted focus groups with 9 small-corp clients. Despite a limited budget, this approach provided broad feedback and deeper insights into how users perceived key features like the mobile dashboard and streamlined payment process.

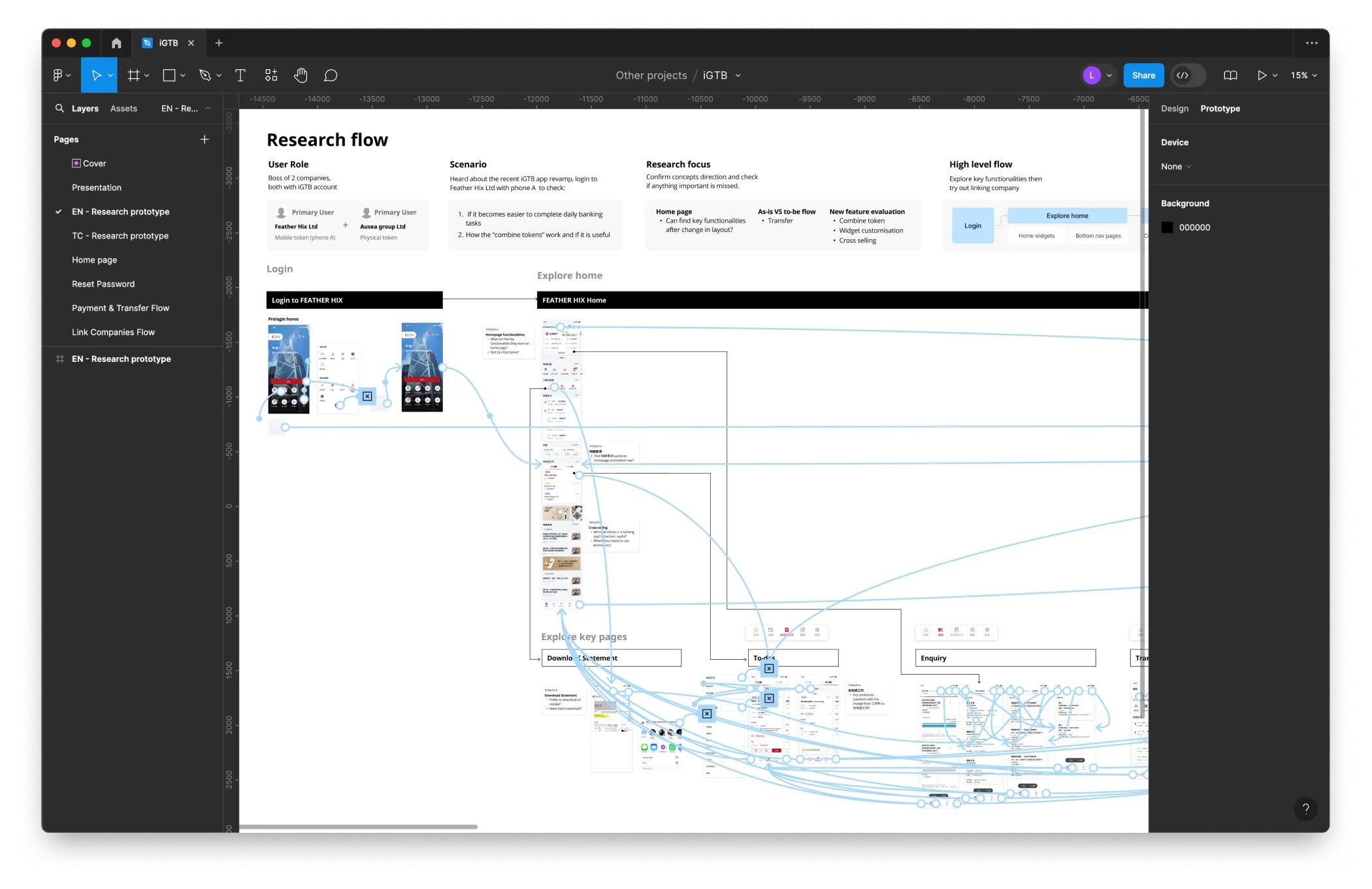

Collaborating with Research Agency

We also partnered with a banking-focused research agency to further validate the features. I developed an interactive prototype and detailed test flow with targeted questions, ensuring we gathered meaningful feedback to refine and optimize the solutions.

Final Outcome

The first phase launched successfully in mid-2024. This update streamlined processes, significantly improving user convenience and driving higher adoption of the mobile app among small-corp corporate customers.

Official Product Page

Impact

22% increase in app downloads

Improved app downloads by 22% after redesigning dashboard navigation and introducing mobile-only features like password reset, enhancing user engagement on mobile.

Save two full-time positions

Introduced online password reset, reducing the need for staff to handle offline applications, saving the equivalent of two full-time positions and lowering operational costs.

App Widely Appreciated by Users

Received excellent customer feedback for usability improvements. A small-corp customer shared, “This version improved so much, I can now easily find balance and payment details.”

What I learned

Mutual Help

Build long-term relationships by providing mutual value, like collaborating with the business team to map customer journeys and learn how the product works.

Focus on data that matters

Avoid inefficiently sifting through all data. Focus on relevant information that aligns with project goals.

Seek IT expertise

Collaborating with IT prevents wasting time on solutions that may not work within system limits, ensuring feasible design outcomes.